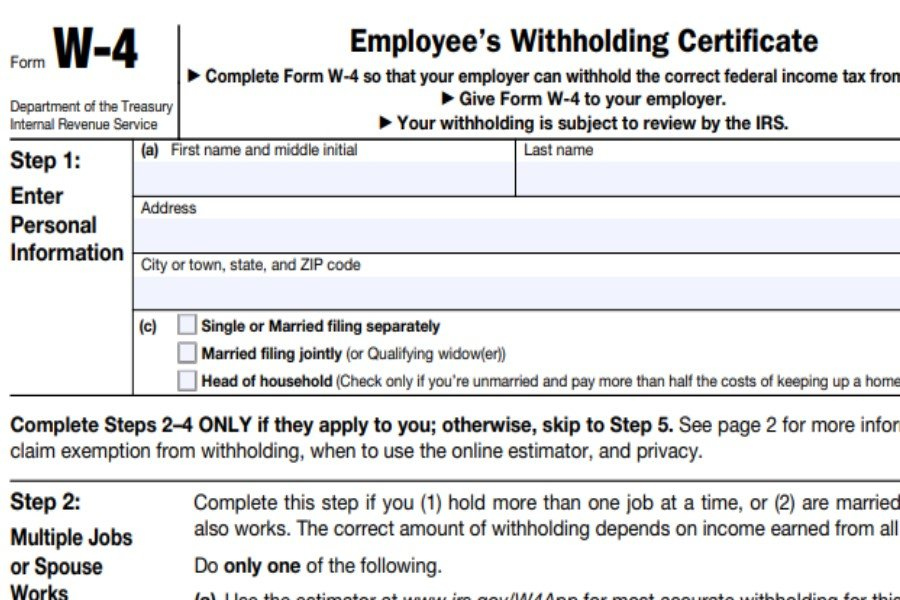

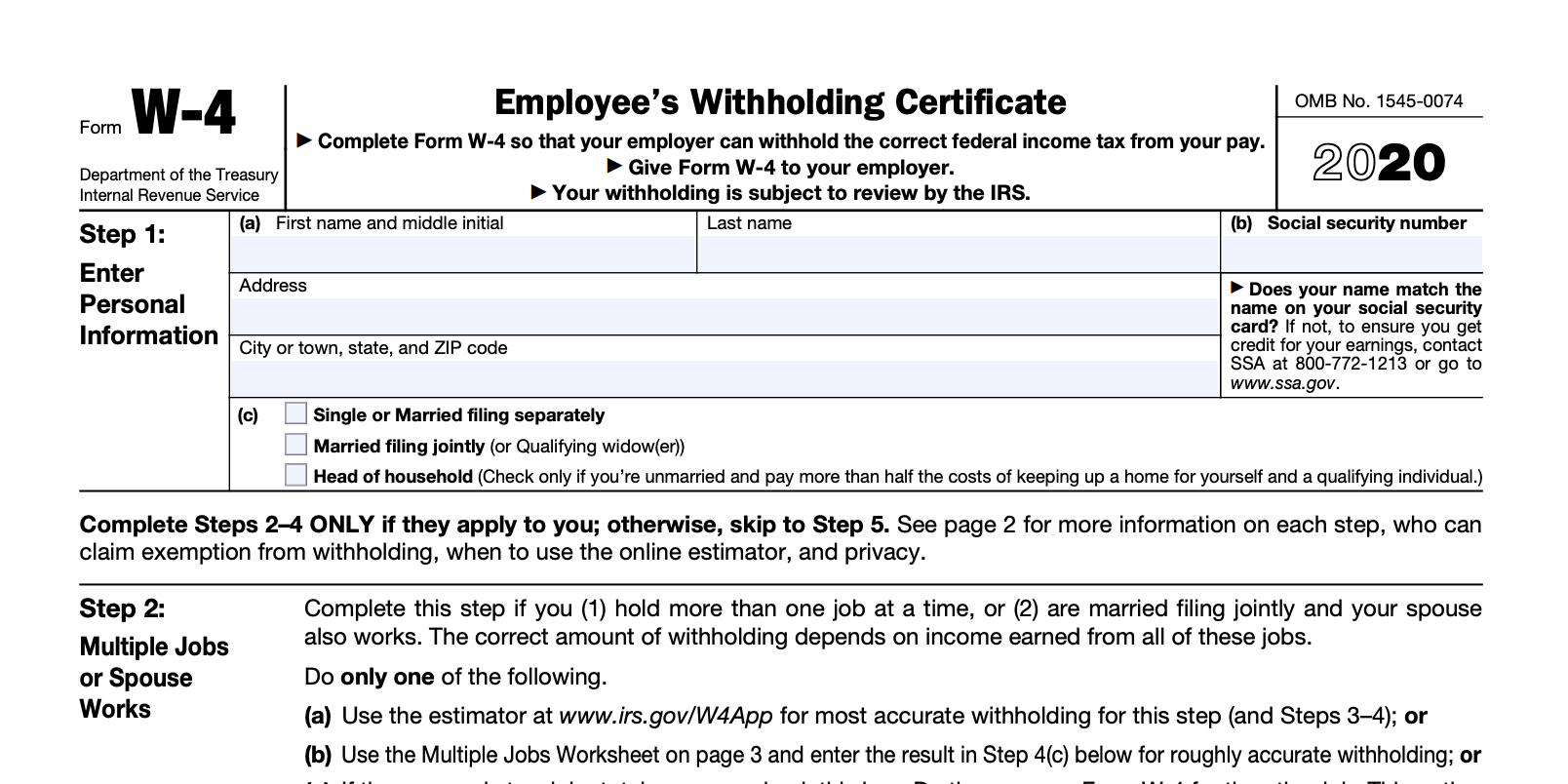

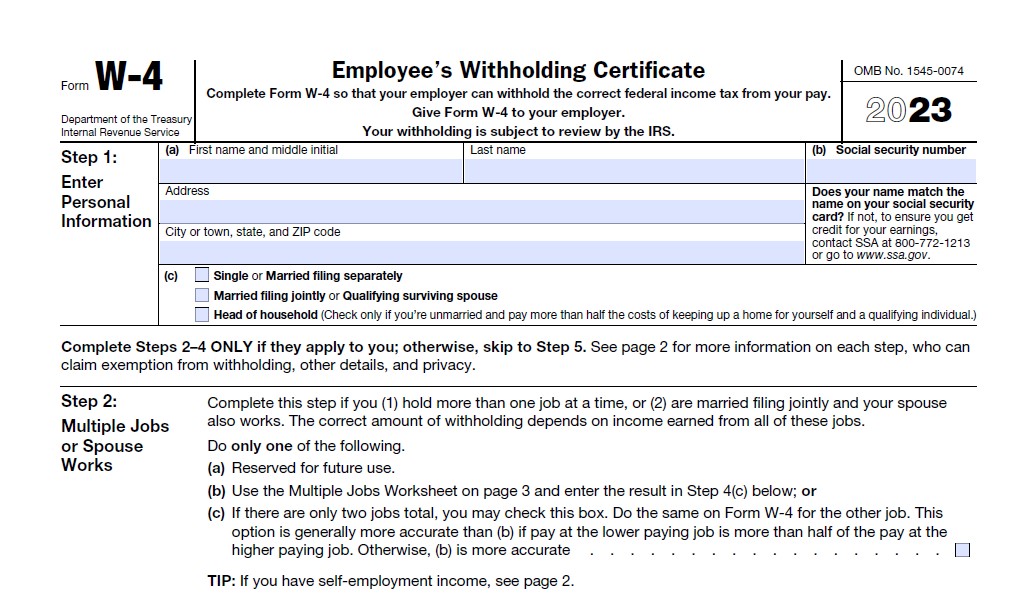

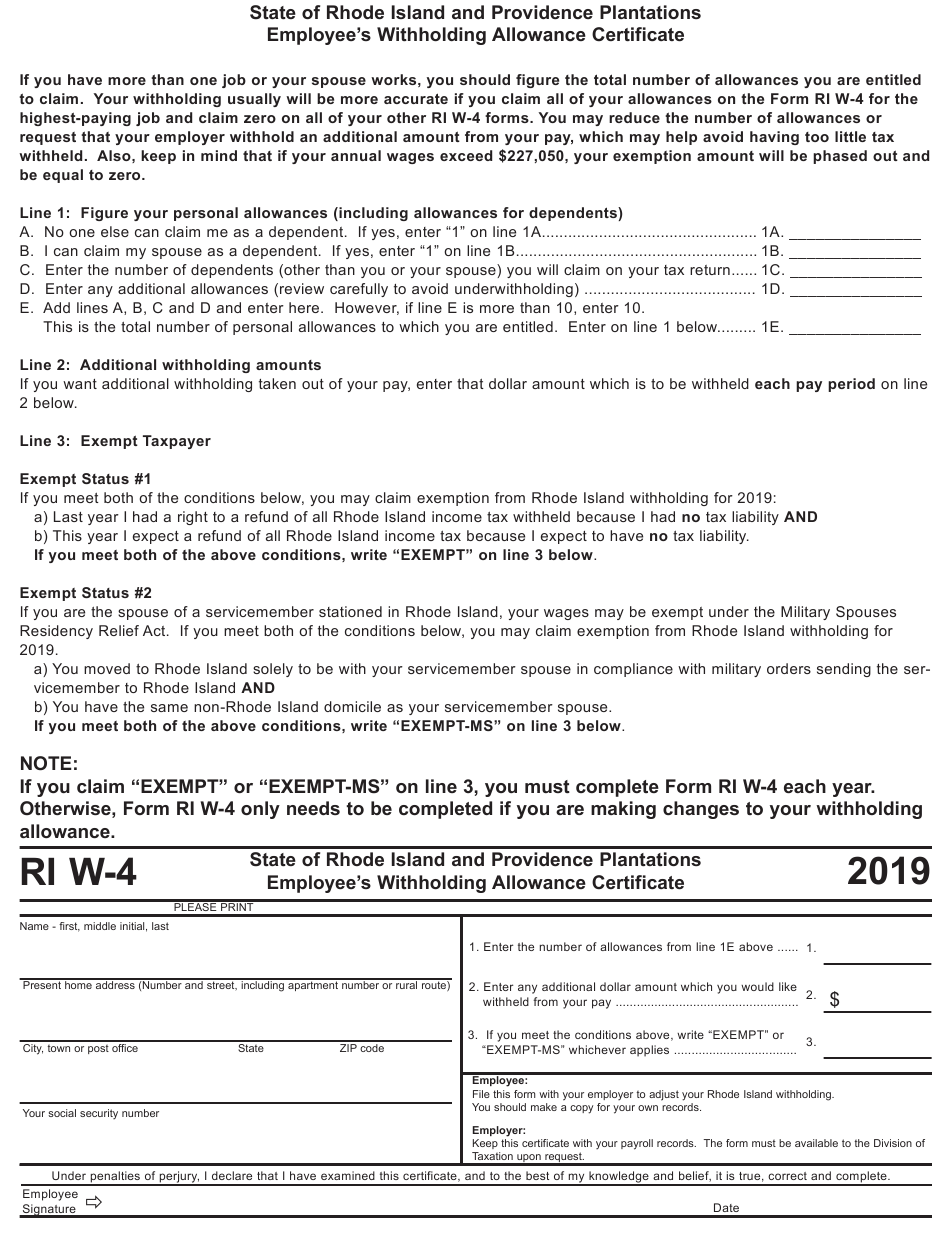

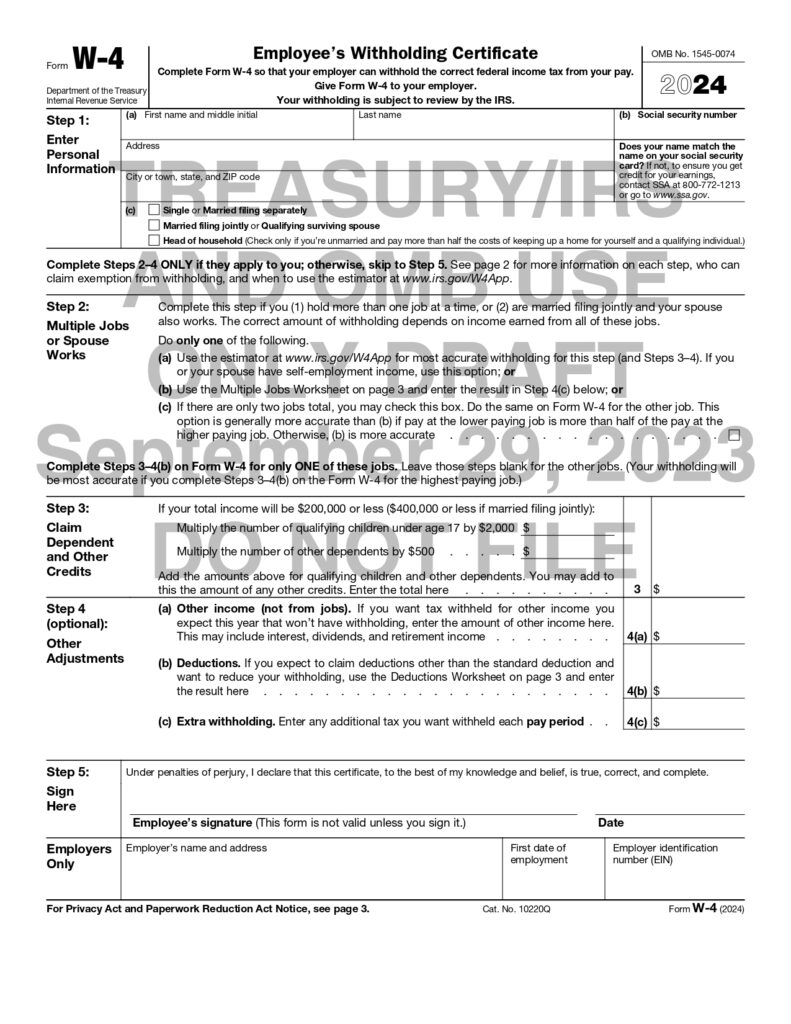

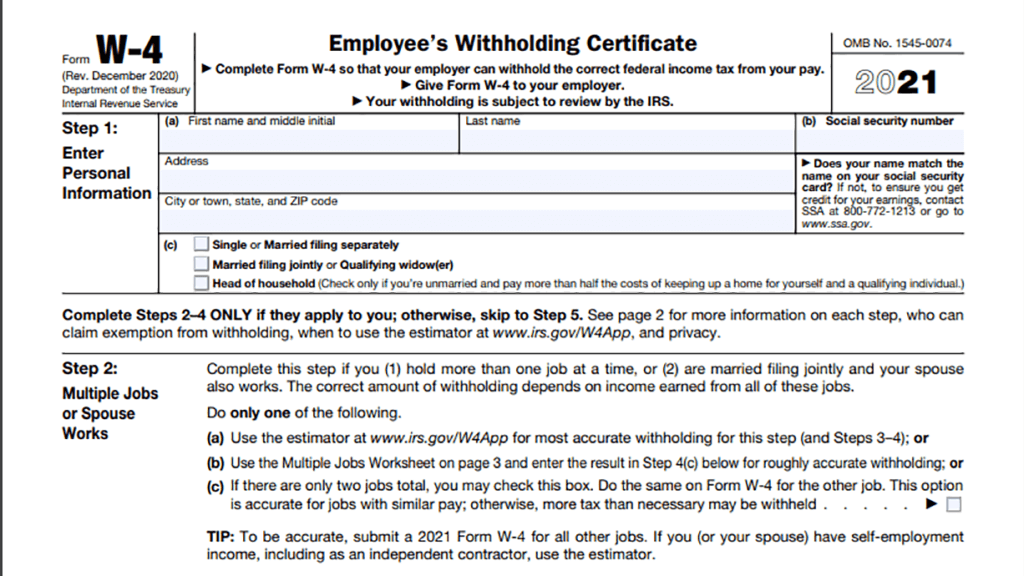

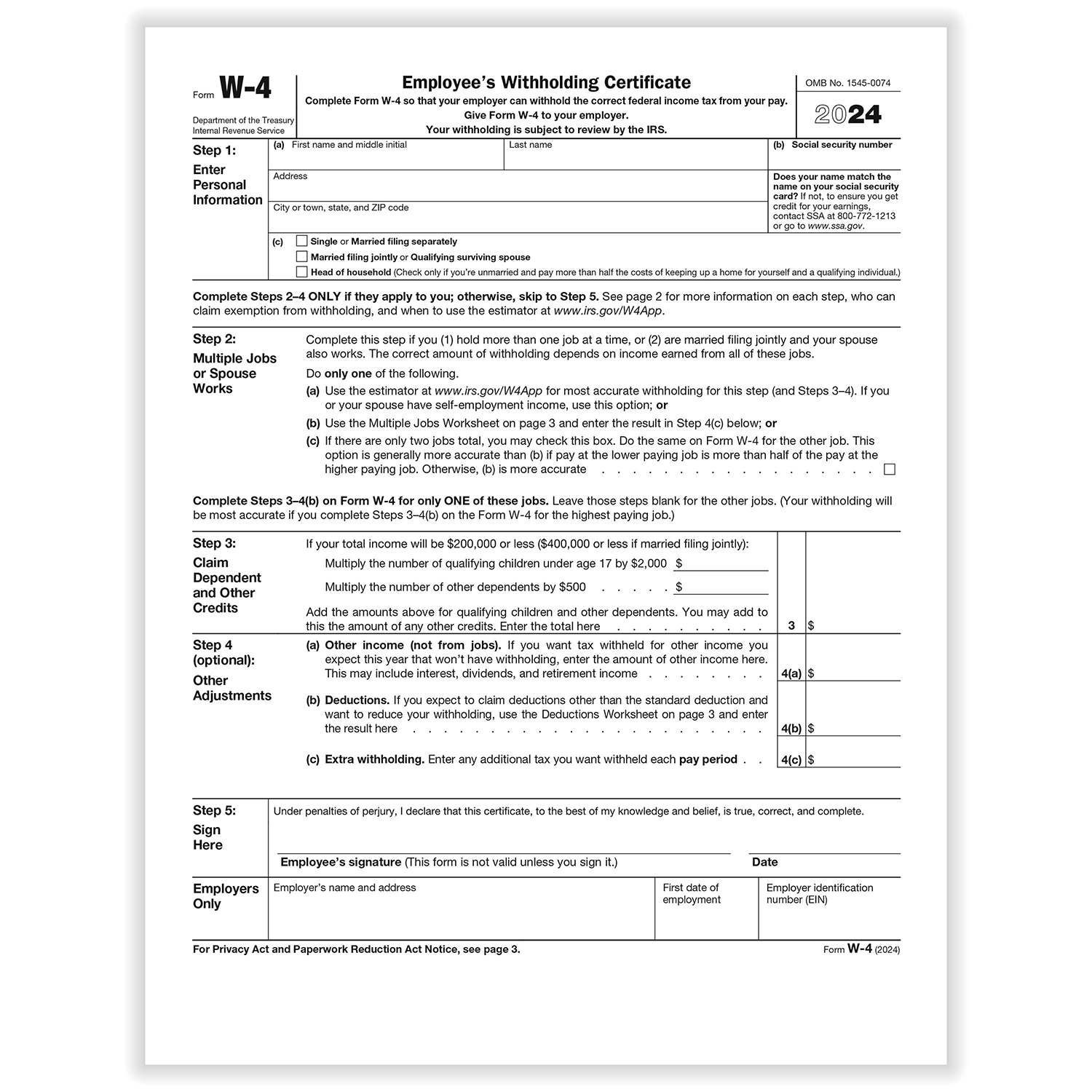

Rhode Island 2025 W4 Form 2025. This calculator allows you to calculate federal and state withholding for the state of rhode. When it comes to filing taxes in rhode island, it is important to understand.

When it comes to filing taxes in rhode island, it is important to understand. Updated and reflecting the 2025 tax filing requirements, the new version of the.

2025 2025 Tax Form Pdf Sophie Mackenzie, Calculate/estimate your annual federal tax and rhode island tax commitments with the rhode island tax calculator with full deductions and allowances for 2025 and previous tax years

W4 Form 2025 Printable Free 2025 Dan Tucker, Withholding formula >(rhode island effective 2025)< subtract the nontaxable biweekly thrift.

W4 Form 2025 Printable Free 2025 Sean Morrison, The 2025 tax rates and thresholds for both the rhode island state tax tables and federal tax.

W4 Form 2025 Nebraska Chloe Peake, The average social security benefit will reach $1,976 per month in january 2025.

2025 W4 Form Download Piers Piper, You can complete the forms with the help of efile.com free tax calculators.

California State W4 Form 2025 Chloe Coleman, Updated and reflecting the 2025 tax filing requirements, the new version of the.

2025 W 4 Tax Form William Mackenzie, On or before january 31 of each year (or at the termination of business), each employer must.

CtW4 Form 2025 Nicky Evangeline, The 2025 tdi taxable wage base for rhode island employees will be $89,200.

W4 Form 2025 Printable Maribel Cortez, When it comes to filing taxes in rhode island, it is important to understand.